Find all related publications

Publications

Find all related Progressive Post

Progressive Post

Find all related events

Events

Upcoming

Past

Find all related Audiovisual

Audiovisual

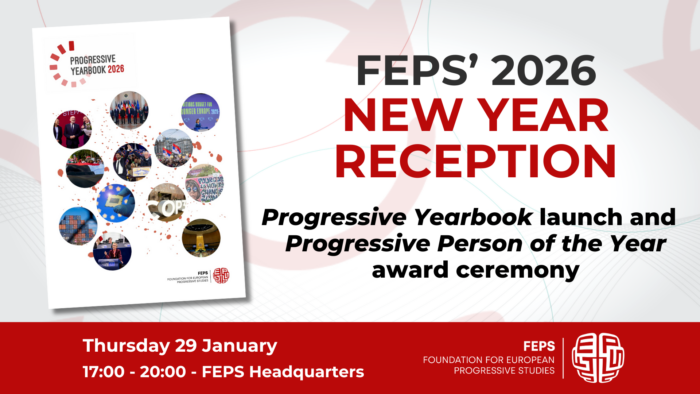

29/01/2026

29/01/2026

Find all related news

News

Find all related in the media

In the media

España los forma, Europa los contrata: así es el mapa de la nueva fuga de cerebros

by El Confidencial 10/02/2026

“Back to the Future: The Great Reset”

Opinion article by FEPS Vice-President, Lina Gálvez reflecting on the current global crisis marked by rising authoritarianism, digital power and extreme inequality, and tracing its roots through a historical analysis of capitalism — from the post-1945 social and geopolitical settlement led by social democratic forces, through neoliberal financialisation, to what she describes as a new phase of fascist capitalism.

“What will the EU develop from now on?”

Analysis by FEPS Secretary General László Andor in Portfolio (HU), highlighting the new MFF’s shift toward increasing EU own-resources, boosting funding for strategic domains like defense, stabilisation and competitiveness, and calling for a flexible crisis-response mechanism such as the proposed Emergency Crisis Response Mechanism

“A new EU budget cycle begins”

Article by FEPS Secretary General László Andor in Novi Vremena (BG), highlighting that while Europe must strengthen fiscal capacity to support balanced growth and strategic autonomy, priorities such as cohesion, defense, and social investment must be built into the next multiannual financial framework.