Find all related publications

Publications

Find all related Progressive Post

Progressive Post

Find all related events

Events

Past

29/01/2026

FEPS HQ

17/11/2025

FEPS HQ, Brussels (Expert meeting)

08/11/2025

Santa Marta, Colombia

Load more...

Find all related Audiovisual

Audiovisual

29/01/2026

29/01/2026

Find all related news

News

Find all related in the media

In the media

“What will the EU develop from now on?”

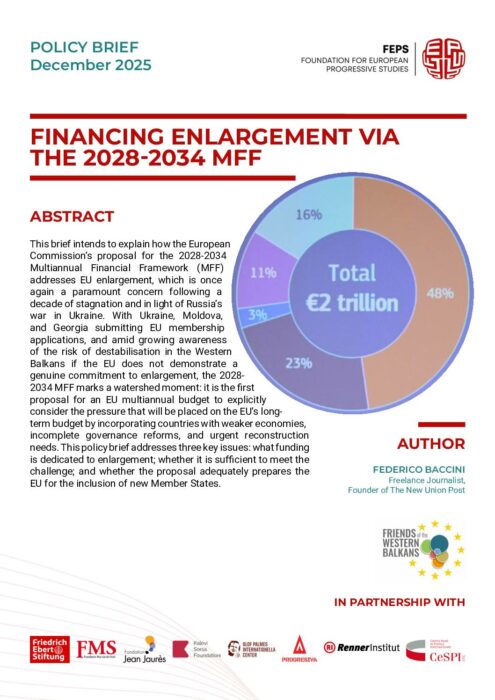

Analysis by FEPS Secretary General László Andor in Portfolio (HU), highlighting the new MFF’s shift toward increasing EU own-resources, boosting funding for strategic domains like defense, stabilisation and competitiveness, and calling for a flexible crisis-response mechanism such as the proposed Emergency Crisis Response Mechanism

“A new EU budget cycle begins”

Article by FEPS Secretary General László Andor in Novi Vremena (BG), highlighting that while Europe must strengthen fiscal capacity to support balanced growth and strategic autonomy, priorities such as cohesion, defense, and social investment must be built into the next multiannual financial framework.

“It’s a mistake to think we can go back to the old normal after Trump”. Interview with FEPS Secretary General László Andor in Telex (HU), where he discusses the global trade tensions triggered by Trump-era tariffs, the shifting US-China dynamic, and the need for the EU to develop a new strategic approach in a permanently changed world order.