Network

Related events

Related publications

Find all related publications

Publications

Find all related events

Events

Upcoming

Past

Find all related Audiovisual

Audiovisual

04/02/2026

29/01/2026

29/01/2026

Find all related news

News

Find all related in the media

In the media

España los forma, Europa los contrata: así es el mapa de la nueva fuga de cerebros

by El Confidencial 10/02/2026

“Back to the Future: The Great Reset”

Opinion article by FEPS Vice-President, Lina Gálvez reflecting on the current global crisis marked by rising authoritarianism, digital power and extreme inequality, and tracing its roots through a historical analysis of capitalism — from the post-1945 social and geopolitical settlement led by social democratic forces, through neoliberal financialisation, to what she describes as a new phase of fascist capitalism.

‘Bruselas, ¿te Quiero?’ Tras un verano cruel, Von der Leyen pide a Europa que “luche”

by Euronews 16/09/2025

“What will the EU develop from now on?”

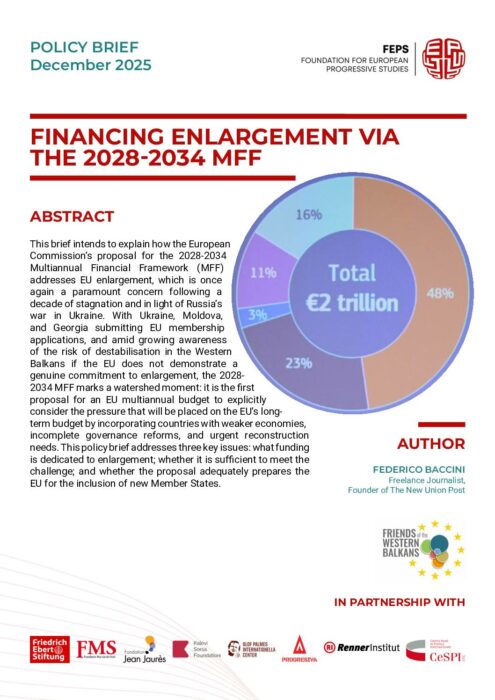

Analysis by FEPS Secretary General László Andor in Portfolio (HU), highlighting the new MFF’s shift toward increasing EU own-resources, boosting funding for strategic domains like defense, stabilisation and competitiveness, and calling for a flexible crisis-response mechanism such as the proposed Emergency Crisis Response Mechanism